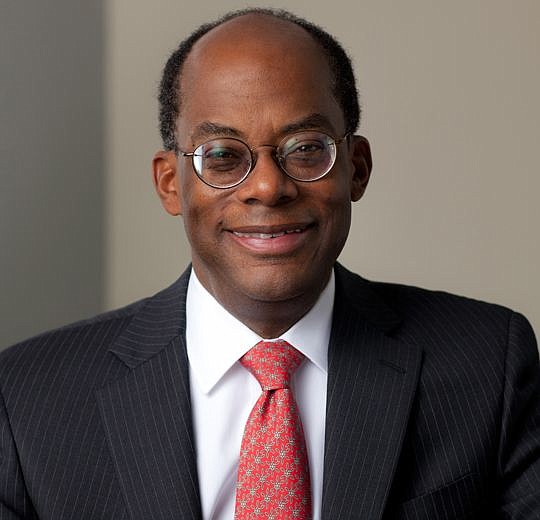

As far as TIAA Chief Executive Officer Roger Ferguson was concerned, the question wasn’t whether his company could afford the $2.5 billion price tag for EverBank Financial Corp.

The question was, how could it afford not to?

After agreeing last week to buy Jacksonville-based EverBank, Ferguson held an all-employee phone call to explain the rationale for the deal.

TIAA is a private, not-for-profit company, but since EverBank is public, EverBank posted a transcript of the call in a Securities and Exchange Commission filing.

“So why are we doing this? Several years ago we decided we needed to add banking services to our portfolio of capabilities, not only to achieve our long-term strategy, but more importantly, to fulfill our customer-focused mission. Because lifetime financial well-being is built on a lifelong series of financial decisions, and for most people, that starts with savings,” Ferguson said.

TIAA is a diversified financial services company that focuses on serving people in the academic, research, medical, cultural and government fields.

The company opened a bank in 2012 and plans to merge it into EverBank to expand its operations.

“Some of you might be wondering how we can afford to do this in today’s challenging economic environment. I might say that we can’t afford not to do it,” he said.

“It’s true that we need to continually manage expenses prudently in response to the financial pressures driven by interest rates that have been much lower for much longer than originally forecast and also by ongoing market volatility and uncertainty,” he said.

“But we need to work both sides of the margin equation, growing revenue and managing expenses. That means we’ll continue to invest in the business and seize smart opportunities that help us achieve our goals including the right inorganic opportunities like this one,” Ferguson continued.

“Savings and borrowing are essential components at all life stages. And this acquisition will enable us to scale more quickly in this area and bring new sources of revenue and margins to the firm,” he said.

TIAA hopes to complete the acquisition next year but a Bloomberg News report last week said the deal could face some regulatory snags.

Banking regulators have become wary of non-bank financial services companies operating large FDIC-insured banks and they may be concerned that TIAA’s existing bank is much smaller than EverBank.

TIAA’s bank has about $4 billion in assets, while EverBank has $27.4 billion.

Some of the language in the merger agreement gives TIAA an out if regulators make it difficult, Bloomberg said.

The agreement includes a provision where EverBank would have to pay TIAA a $93.2 million breakup fee if the deal is terminated under certain conditions.

TIAA intends to keep the headquarters of the merged bank in Jacksonville, while TIAA’s trust division will continue to be headquartered in St. Louis, Ferguson said in the phone call.

He said no decisions have been made on staffing but he tried to assuage employee concerns.

“It’s important to note, this is not an acquisition driven by cost-cutting synergies. This is about growing our business, serving our institutional and individual customers in new ways and strengthening our company for the future,” he said.

Advanced Disposal refiles IPO statement

Advanced Disposal Services Inc. on Thursday refiled its registration statement for an initial public offering, but gave no indication when it may try to bring the stock sale to the market.

The waste management company, headquartered in the Nocatee development in St. Johns County, tried to launch its IPO in February but pulled the stock sale back because of poor market conditions during the winter.

Advanced Disposal was hoping to sell about 21.4 million shares of stock at $20 to $22 each, according to its last previous registration statement in February.

Thursday’s updated filing did not indicate the amount of stock that would be sold.

Advanced Disposal reported net income of $200,000 for the second quarter, reversing a loss in the second quarter of 2015.

Revenue rose by 0.8 percent to $358.2 million.

PHH Corp. studying ‘strategic alternatives’

Struggling PHH Corp. last week reported a second-quarter core loss of $4 million, or 8 cents a share, as the mortgage banking company continues to review possible “strategic alternatives.”

During the company’s conference call with analysts, CEO Glen Messina said PHH was not ready to comment on those alternatives as it goes through the process of assessing its business.

“I can report that we remain very active and are progressing at an intense pace that balances the need for a conclusion, while considering the unique and complex nature of our business platforms and related relationships,” he said.

“I can assure you that we continue to act with a sense of urgency and we look forward to sharing more information when it is prudent to do so,” Messina said.

PHH is headquartered in New Jersey but has maintained a large mortgage operations center in Jacksonville. However, the company has downsized its operations, moving out of its offices at 5201 Gate Parkway to a smaller office at 8000 Baymeadows Way W.

The company’s Jacksonville employment had dropped from more than 1,000 three years ago to 450 last fall when it made the decision move to smaller offices.

The former PHH Mortgage building on Gate Parkway officially reopened last week as an operations center for Deutsche Bank.

Fund manager cuts FNF stake

An activist hedge fund manager who began buying shares of Jacksonville-based Fidelity National Financial Inc. three years ago has sold a significant chunk of his stake, according to SEC filings.

Keith Meister and Corvex Management LP had become one of Fidelity’s largest stockholders, controlling 20.2 million shares, or 7.4 percent of the company’s stock, according to Fidelity’s proxy statement in the spring.

However, a new filing last week shows Corvex has sold off about 7 million shares since then, reducing its stake to 4.8 percent.

With its stake falling below 5 percent, it will no longer have to file reports about its investment in Fidelity.

When Meister and Corvex first started buying shares in 2013, the SEC filings said Meister was interested in having discussions with Fidelity management about its business. Last week’s filing does not give any reasons for the recent stock sales.

Analyst unhappy with Rayonier AM stock sale

After reporting two straight quarters of earnings well above analysts’ forecasts, Rayonier Advanced Materials Inc. “doused the fires of optimism” by selling $150 million in preferred stock that can be converted into common stock, D.A. Davidson analyst Steven Chercover said.

He was so optimistic after Rayonier AM’s earnings report two weeks ago that he increased his price target for its stock from $17.50 to $25.

But in a report last week, Chercover said he was cutting the target back to $22 because of the preferred stock sale.

“We were shocked that, after paying down nearly $200 million in debt since inception two years ago, and generating $113 million in free-cash in the first half of 2016, management would dilute (long suffering) common shareholders to de-lever,” he said.

Rayonier AM’s stock dropped by $2.92 to $12.91 on Aug. 4 after announcing the stock sale.

Chercover maintains his “buy” rating on the stock but said of the stock sale, “in summary, we were not impressed.”

TapImmune sells more stock

TapImmune Inc. last week said it is raising $8.5 million by selling stock through a private placement and the exercise of warrants to buy stock from existing investors.

The company, which is developing technologies to treat cancer, moved its office to Jacksonville last year as the Mayo Clinic began a clinical trial of its breast cancer treatment. It will use proceeds from the stock sale for general corporate purposes, including clinical trial expenses and research and development.

The company also said it applied to list its stock on the Nasdaq Capital Market. The stock currently trades on the Over-The-Counter Bulletin Board.

Convergys stock hits 14-year high

Convergys Corp.’s stock rose to its highest level in 14 years after reporting better-than-expected earnings and increasing its earnings forecast for the rest of the year.

The Cincinnati-based company, which provides outsourced customer service for businesses, reported second-quarter earnings of 41 cents a share, 8 cents higher than last year’s second quarter and 4 cents higher than the average analysts’ forecast, according to Thomson Financial.

Convergys also increased its earnings growth forecast for the full year, reflecting the recent acquisition of a German company called buw.

It now projects earnings to grow by 7 percent to 9 percent, after previously forecasting growth of 5 percent to 8 percent.

The company’s stock rose as much as $2.70 to $29.96 Tuesday after the earnings report, its highest level since 2002.

Convergys employs more than 1,200 people at its Jacksonville call center.

Flowers Foods hits four-year low

Flowers Foods Inc. fell to its lowest level in almost four years last week after a double whammy of bad news.

First on Wednesday, the bakery products company disclosed in an SEC filing that the U.S. Department of Labor launched a compliance review under the Fair Labor Standards Act.

Flowers gave no other details, but that news sent its stock down by $1.60 to $16.15 Wednesday.

The next day, Flowers reported second-quarter adjusted earnings of 26 cents a share, matching analysts’ forecasts, but sales of $935 million were $14 million below the average forecast, according to Thomson.

Flowers also lowered its earnings forecast for the full year, from its previous projected range of $1 to $1.06 to a range of 90 cents to 95 cents.

The company’s stock dropped as much as $1.80 to $14.35 Thursday, its lowest level since November 2012.

Flowers also announced it has started a review to evaluate opportunities “to enhance revenue growth, streamline operations, drive efficiencies, and make investments that strengthen its competitive position and improve margins over the long term.”

Thomasville, Ga.-based Flowers operates a bread bakery in Jacksonville and also owns an idle Northside bakery it acquired when it bought the Hostess bread business in a U.S. Bankruptcy Court auction in 2013.

The company has not decided what to do with the former Hostess facility.