Fidelity National Financial Inc., which has invested in a number of restaurant chains, is the largest stockholder of Del Frisco’s Restaurant Group Inc. and has been a passive investor since it started buying shares a year ago.

However, Reuters news service reports that two relatively small activist shareholders are pushing for a potential sale of the restaurant company, which operates 52 restaurants under the Del Frisco’s Double Eagle Steak House, Sullivan’s Steakhouse, and Del Frisco’s Grille brands.

Citing unnamed sources, Reuters last week said Engine Capital, which owns 1.25 percent of Del Frisco’s, told company officials they need to improve operations or seek a sale. Also, Ancora Advisors, which owns 0.84 percent of the stock, is pushing for a sale, it said.

Fidelity owns 13 percent of the stock, according to Del Frisco’s April proxy statement.

Jacksonville-based Fidelity, which is mainly a title insurance company, has a history of investing excess cash in non-title investments through its Fidelity National Financial Ventures unit and the restaurant industry has been a major focus.

Fidelity owned 87.4 percent of J. Alexander’s Holdings Inc. and spun that restaurant business off as a separate public company last year.

Fidelity still owns a 55 percent stake in American Blue Ribbon Holdings, which operates four restaurant chains, and has been exploring options to possibly sell or spin off that company for the last couple of years.

While Fidelity has been a controlling shareholder and actively involved in the operations of those restaurant companies, it hasn’t been involved in Del Frisco’s management.

Fidelity Chairman Bill Foley said when the company began buying Del Frisco’s shares last year he viewed the company as an attractive investment.

Del Frisco’s stock was trading in the mid-$13s when Fidelity first bought shares in October 2015 and was in the mid-$16s last week, helped by speculation about a sale.

The company’s reported earnings of 45 cents a share for the first nine months of this fiscal year were 11 cents higher than last year, with sales up 6.9 percent to $232.5 million.

However, comparable-restaurant sales (sales at restaurants open for more than one year) fell 1.6 percent.

As talk of a possible sale emerged last week, Del Frisco’s also introduced a new CEO.

The company said Mark Mednansky retired as CEO and was succeeded by restaurant industry veteran Norman Abdallah, who had been sitting on Del Frisco’s board of directors.

A news release announcing the change noted Abdallah’s experience includes time as CEO of Romano’s Macaroni Grill, where he “led the turnaround” that “resulted in a sale to Ignite Restaurant Group.”

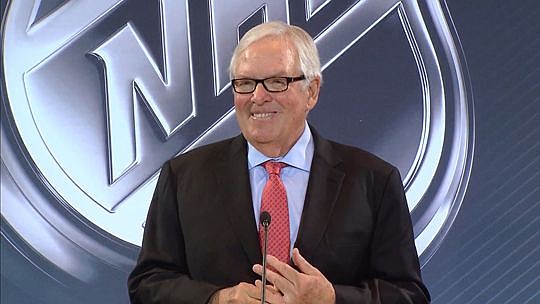

Foley’s hockey team named Golden Knights

Foley may not have time to get involved with Del Frisco’s because he has so many other interests, including his National Hockey League expansion franchise in Las Vegas.

Last week, he announced the team would be the Vegas Golden Knights.

Foley is the lead partner in a group that was awarded the franchise in June, but the team did not have a name.

As a graduate of the U.S. Military Academy at West Point, Foley wanted to use the name of Army’s sports teams, the Black Knights.

Foley used the name for the mortgage processing technology company spun off from Fidelity, Black Knight Financial Services Inc.

However, officials of the military academy apparently didn’t want to see that name used for a professional team and either officially or unofficially discouraged him from using it for the hockey team.

After months of speculation, Foley announced the name Golden Knights at an event outside the new Las Vegas arena that will be home for the team when it begins play next season.

“We selected ‘Knights’ because knights are the defenders of the realm and protect those who cannot defend themselves. They are the elite warrior class,” said Foley, according to a news release.

The “Golden” part of the name has significance in the Las Vegas community because Nevada is the largest producer of gold in the U.S.

FIS gets ‘overweight’ rating from analyst

Another company spun off from Fidelity National Financial is poised to continue profiting from its dominant position in the banking technology sector, according to one analyst.

Pacific Crest Securities analyst Arvind Ramnani initiated coverage of Jacksonville-based Fidelity National Information Services Inc., or FIS, with an “overweight” rating as part of an overall assessment of the financial technology industry.

“We believe FIS’ dominant position in the core bank processing market provides a highly stable, recurring and sticky revenue stream,” Ramnani said in his research report.

“Its SunGard acquisition provides greater scale, complementary capabilities and cost-saving synergies. Its global presence and digital offerings could deliver upside to revenue growth,” he said.

FIS acquired SunGard Data Services Inc. a year ago and says the integration of that business is ahead of schedule.

Ramnani set an $86 price target for FIS’ stock, which was trading at $75.87 at the time of his report.

Medtronic quarterly results disappoint

Medtronic plc’s stock dropped Tuesday after a disappointing quarterly report.

The medical device company reported adjusted earnings of $1.12 a share for its second quarter ended Oct. 28, 9 cents higher than last year and in line with analysts’ forecasts.

However, revenue of $7.35 billion, while 4 percent higher than last year, was lower than the average analysts’ forecast of $7.46 billion, according to Yahoo Finance.

Revenue for Medtronic’s Jacksonville division, which produces surgical instruments for ear, nose and throat doctors, rose in the “low single digits,” the company said in a news release without further details.

The company’s specialty therapies group, which includes the ENT division, increased revenue by 6 percent to $369 million.

“Q2 revenue was disappointing and did not meet our expectations. We faced issues that affected our growth, including slower than expected revenue as we await new product introductions, particularly in CVG (cardiac and vascular group) and diabetes,” Medtronic CEO Omar Ishrak said in a news release.

Medtronic lowered its earnings forecast for the full fiscal year to a range of $4.55 to $4.60 a share, compared with its previous projection of $4.60 to $4.70.

Medtronic’s stock fell $6.98 to $73.60 Tuesday after the earnings report.

FRP fourth-quarter earnings down slightly

Jacksonville-based commercial real estate developer FRP Holdings Inc. reported earnings of $1.96 million, or 20 cents a share, for the fourth quarter ended Sept. 30, slightly lower than last year’s earnings of $2.07 million, or 21 cents.

Revenue rose 9.9 percent to $9.78 million.

Although FRP issued its earnings report Tuesday, it is not holding its conference call to discuss the results until this week.

Drone Aviation increasing revenue

Drone Aviation Holding Corp. reported a third-quarter net loss of $3.7 million, or 54 cents a share, on revenue of $146,208.

However, the Jacksonville-based company, which makes tethered drones and lighter-than-air aerostats, said its revenue for the first nine months of this year quintupled to $1.07 million.

It also expects further revenue increases from recently announced contracts, including two from the U.S. Department of Defense.

“We believe both of these DoD awards reflect early validation of the benefits and value of the company’s tethered drone technology and, importantly, will contribute to our growing backlog, which we expect to convert into revenue during the fourth quarter of 2016 and the first half of 2017,” CEO Jay Nussbaum said in a letter to shareholders.

Duos Technologies revenue drops

Duos Technologies Group Inc. reported a third-quarter net loss of $591,074, or 1 cent a share, according to its quarterly report filed with the Securities and Exchange Commission.

Revenue fell 39 percent to $1.37 million for the Jacksonville-based company, which provides intelligent analytical technology solutions.

Duos’ report said the drop in revenue was due in part to delays in implementation of some projects and IT asset management services that were expected to begin during the third quarter.