A bill containing a city-backed emergency loan program to provide operating capital for small businesses hit by the response to COVID-19 will be filed April 3.

Jordan Elsbury, director of intergovernmental affairs for Mayor Lenny Curry’s administration, said attorneys are reviewing the program partnership with VyStar Credit Union and the bill should be ready for an emergency City Council vote April 6.

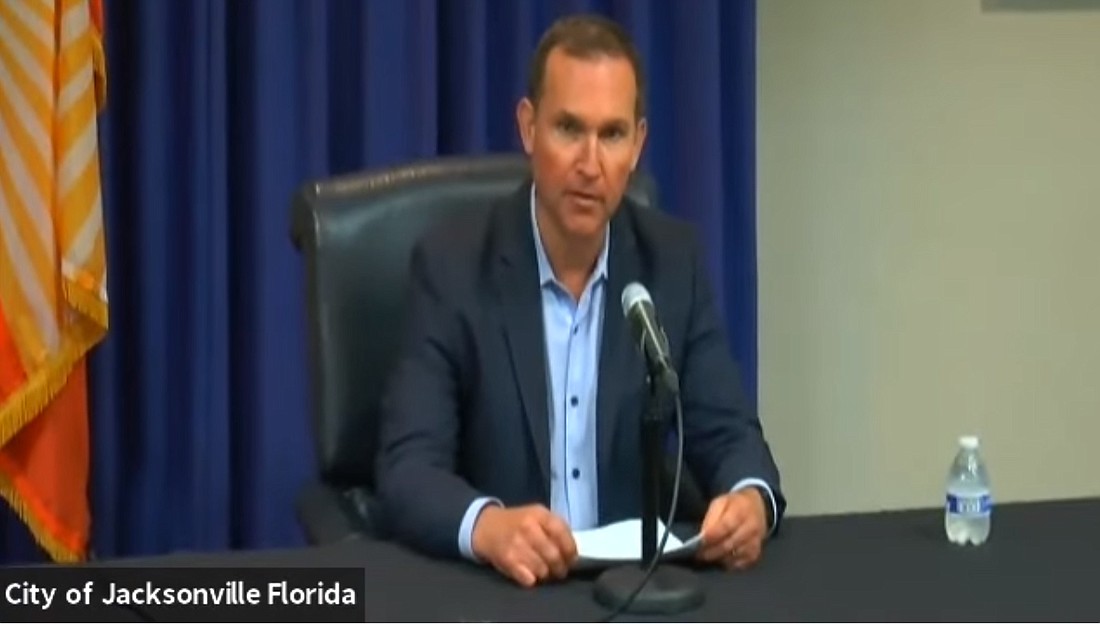

Elsbury released the timeline April 2 during Curry’s daily virtual media briefing on the city’s response to the coronavirus.

The legislation will include final program details that include a $20 million to $30 million contribution from the city for a combination of grants, interest payments and potential aid toward loan principals directed as small businesses.

VyStar CEO Brian Wolfburg told the Daily Record on April 1 that loans up to $100,000 will be available for businesses approved for the program. Businesses will receive an immediate $1,000 grant from the city tied to the loan, which is a line of credit.

Businesses can draw on that credit line for up to six months, with no payments due in the first year. The city will cover all interest payments in the first year. Repayment will begin in year two.

Curry said loan approval will take up to 72 hours after an application is submitted and businesses could receive the money within five days of applying.

Businesses that meet employee retention requirements will trigger added benefits from the city contribution that could include further interest payment and principal support or forgiveness. Those requirements will be disclosed in the final bill April 3.

When asked April 2 if the emergency program could be expanded to include loan products from other area banks, credit unions and financial institutions, Elsbury said it was VyStar’s existing partnerships with the city, and the credit union’s $50 million in available small business loan capital, that prompted the one-on-one partnership.

“Ultimately, VyStar has the capacity to put the capital to work ASAP which is, quite frankly, what small businesses need at this moment,” Elsbury said.

Curry said Council members have been “very supportive of the idea” and recognized the COVID-19 financial strain on small businesses and city coffers.

The mayor said April 1 that city dollars for the loan program will come from general fund reserves. That reserve fund had $146.4 million available by Council approval as of April 2019, the latest time period for the data.

“But the budgets in the years ahead are going to be incredibly difficult,” Curry said. “If all this ended right now, the budgets in the years ahead while I’m in office for sure are going to be very difficult, with difficult choices and reprioritizing things.”