If you invest in stocks or bonds, you may be more accustomed to one way of getting paid. For stocks, typically you’ll only get paid from stock price appreciation. For bonds, you’ll typically only get paid from the coupon payments (similar to net rental income of rental properties). Since 2000, government bond yields have averaged 2-4% while corporate bonds have averaged 4-6%. Bonds can also appreciate and depreciate in price if the investor sells before maturity.

In comparison, let's take a look at the five profit centers in real estate investing and how they can impact your long-term investment strategy:

1. Net Rental Income: This is the money you make after all expenses (mortgage, insurance, property management fees) are deducted from your monthly rental income.

2. Tax Savings: When you invest in real estate, you can take advantage of numerous tax deductions and write-offs. This can help you save a lot of money come tax time!

3. Principal Paydown: Every month, a portion of your mortgage payment goes towards paying down your balance, paid by your renter. This is a great way to build equity in your property and reduce your overall mortgage balance.

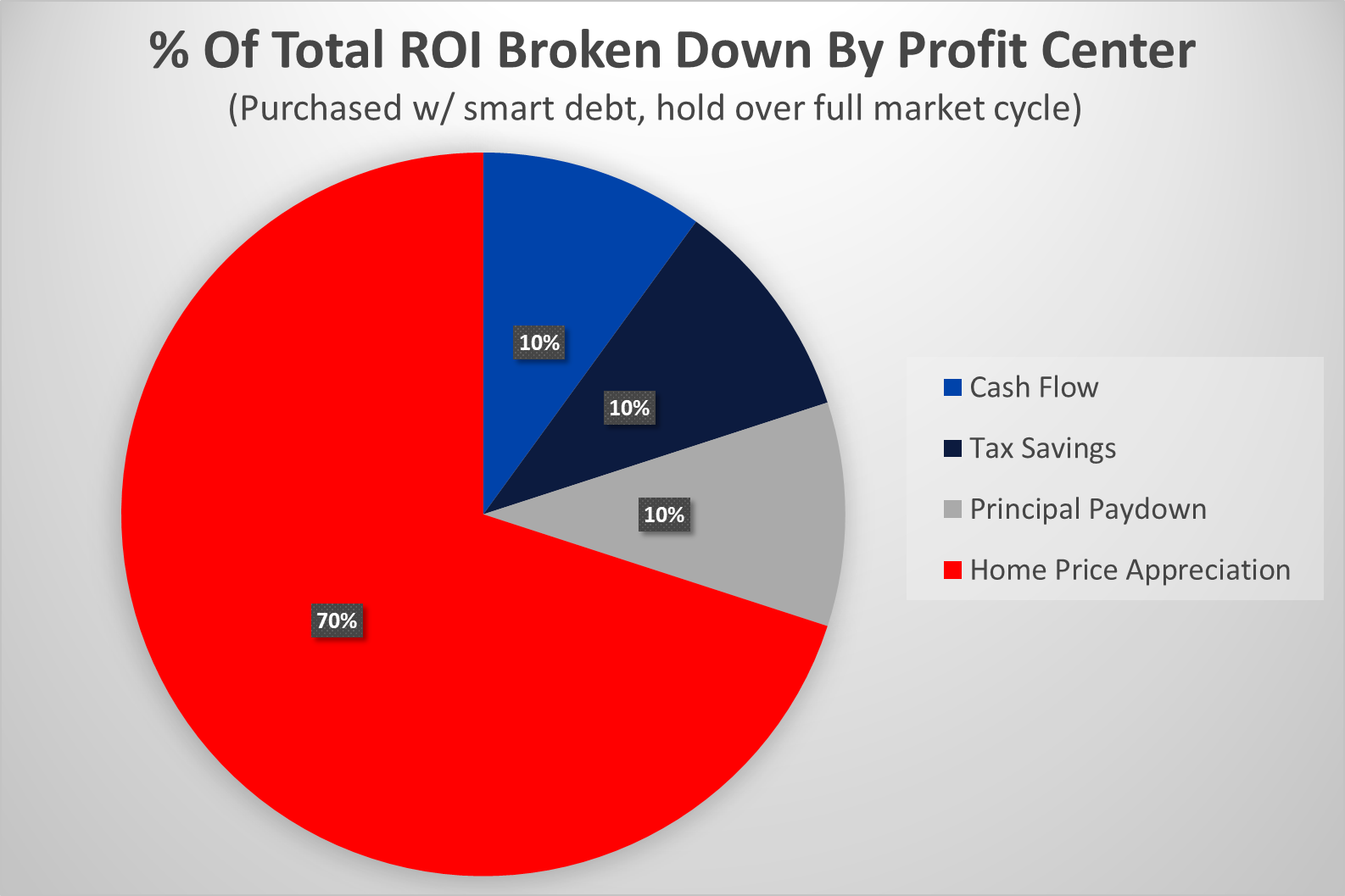

4. Home Price Appreciation: Over time, the value of your property is likely to increase. This can provide you with a nice return on investment when you refinance or sell the property. Out of all of the profit centers, home price appreciation will have the greatest impact on return on investment over a full market cycle (10-20 years.)

5. Inflation Hedging: When inflation goes up, the prices of goods and services also increase. But since your mortgage payments remain the same, your purchasing power actually goes up! This makes real estate a great hedge against inflationary pressures.

This graph shows the percentage of Total Return On Investment (ROI) broken down by profit center when purchased with smart debt and held over a complete market cycle, assuming 4.6% home price appreciation each year on average. Appreciation accounts for 70% of the total return on investment over an entire market cycle, whereas the other profit centers combined account for the remaining 30%. Most people focus on the monthly cash flow, but they miss the other profit centers!

We dive deeper into what is happening to cash flows in rental property investing on our Not your Average Investor Show, where we share insights on the current market:

If you're thinking about investing in Jacksonville real estate, now is a great time to do so. JWB Real Estate Capital is the nation’s only vertically-integrated real estate investment company, helping busy professionals from across the world invest in real estate in Jacksonville, FL. From sourcing turnkey rental properties to finding long-term residents, and comprehensive property management, our expert team offers a full-service solution for a truly stress-free investing experience. Because of our vertically-integrated experience, JWB clients have earned 79% home price appreciation more than the average Jacksonville investor since 2013. Check out our available properties and learn more here.

I love to talk about investing in rental properties! You’ll often find me hosting the weekly Not Your Average Investor Show, contributing to the JWB Real Estate Capital blog, and in our Facebook group connecting with the community & sharing insights.