Lake City-based Blackwater Development LLC announced it is the prospective buyer of Regency Square Mall, the 56-year-old largely vacant shopping center facing code compliance issues for interior problems such as water damage and exposed wiring.

“Blackwater Development has entered into a contract to acquire the Regency Square Mall property,” President Rurmell McGee said in a statement Oct. 16.

“We are currently early in the initial phase of the due diligence process. Our primary objective at this juncture is to conduct a thorough assessment of the property and determine the project’s feasibility.”

It won’t be a quick purchase.

McGee expects the sale could close in the third quarter of 2024.

The center, at 9501 Arlington Expressway, was the area’s first large regional mall. It is at Atlantic Boulevard, Monument Road and the expressway.

Regency Square has struggled as population shifted from Arlington and national, regional and local retailers left or closed.

The parts of the eastern retail wing still open to the public are roped off by security tape around trash containers to collect water from the holes in the ceiling, where water damage has spread and pipes are exposed.

McGee said Oct. 16 Blackwater is working with the current mall ownership “in an effort to determine the necessary repairs needed for the existing structure and garner a full understanding of the outstanding code enforcement violations.”

McGee said Blackwater looked forward to “the opportunity to collaborate with state and local officials, as well as engaging with the Jacksonville community, in an effort to create a comprehensive plan for the revitalization of the Regency Square Mall property.”

“I wholeheartedly believe that a property of this magnitude, combined with its historical significance, holds a pivotal role in shaping the future development and growth of this market,” McGee said.

Asked about specific plans, “It’s really too early to give a definitive answer but we believe this property best serves the market as a mixed-use development.”

He said he had no further statement “until we are further along.”

XERA Realty Inc. of Jacksonville is the broker for the buyer.

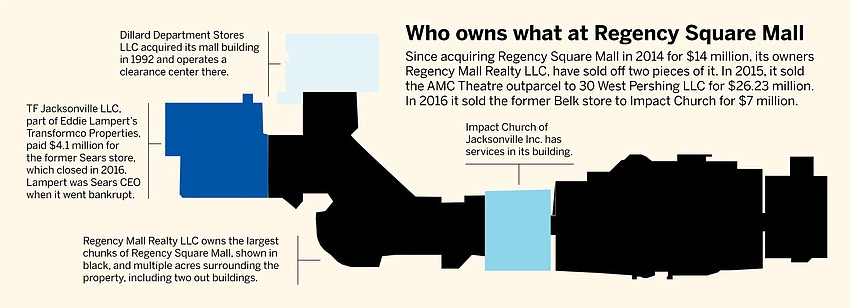

Not all of the mall would be part of the purchase.

Impact Church, the Dillard’s Clearance Center and the former Sears have separate owners and are not part of the Blackwater deal.

McGee’s LinkedIn profile says he founded Blackwater Development in January 2022.

He registered Blackwater Development with the state in June 2022.

The blackwaterdev.com site describes it as a full-service commercial real estate development company with national and regional clients such as Wawa, First Watch, Publix, Heartland Dental, DaVita, Planet Fitness, Circle K and AT&T.

City Council representative Ken Amaro said Oct. 17 that he intends to reach out to Blackwater Development to find out its vision for the area, which is in his district.

"For the entrepreneurs who have invested their life savings in their mall business this is encouraging, as well as for the community hoping to see the revitalization of the mall area," Amaro said.

Former effort

McGee was part of a previous effort to buy the property.

Redevelopment prospects surfaced in June 2020 when commercial real estate developer Rimrock Devlin, associated with Rimrock Development, also based in Lake City, said it had a contract to buy and redevelop the 77.11-acre property into mixed uses.

The deal didn’t close, but the vision showed what could happen with the site.

His LinkedIn pages shows McGee was with Rimrock Development and Rimrock Companies from 2013 through April 2022, most recently as vice president of retail development.

McGee said Micah Linton, manager and agent of Rimrock Companies LLC and Rimrock Development L.L.C, is not part of Blackwater Development or the current Regency transaction.

In 2020, Rimrock said the property could serve multiple uses.

Those include medical services, limited service hospitality, fulfillment centers, multifamily space, charter schools, banks, a convenience store, restaurants and retail, the developer said in a statement.

At the time, it was still early in the due diligence.

Rimrock said there are active leases in place, easements and other encumbrances that will “ultimately dictate the potential of a redeveloped property.”

The developer said it looked forward to working with the city and others on the project.

Rimrock Devlin did not say how the property would be repositioned or if parts of the mall would be demolished.

The developer said mall properties throughout the U.S. are experiencing declines in traffic as consumer purchasing habits changed over the past decade.

It said that created redevelopment opportunities because many mall properties are “in the heart of densely populated retail corridors where people live, work and play.”

Rimrock Devlin called the Regency Square Mall site “a perfect representation of this and unique in its positioning within the Jacksonville market.”

“It’s not often that you find a 70-plus acre tract of land in the heart of a community surrounded by rooftops, local businesses and national brands with frontage on a main thoroughfare encompassing over 100,000 passing cars each day,” it said.

Rimrock Devlin said the mall is central in the Jacksonville market because it is a 15-minute drive to Jacksonville International Airport and the Beaches, not far from Downtown and 10 minutes from St. Johns Town Center.

Regency Square for sale

The mall owners said Oct. 2 they are selling the shopping center that they bought in 2014.

“The company has recently finalized a contract for the sale of Regency Square Mall. More information will be provided as the buyer’s identity becomes public,” said a statement from a representative of Namdar Realty Group.

Regency Realty LLC, a partnership of Mason Asset Management and Namdar Realty Group LLC, both based in Great Neck, New York, paid $13 million for the bulk of the 1.4 million-square-foot mall Feb. 14, 2014.

Property records show Regency Mall Realty LLC owns almost 74 acres and about 980,200 square feet of retail space in the mall.

The property is assessed for tax purposes at $6 million.

The representative did not provide more information Oct. 2 about the identity or potential use of the mall under new ownership or when the sale will be completed.

Regency’s condition

Regency Square’s conditions have been a target of lawmaker complaints and city code compliance.

The city said Oct. 5 it will hold a hearing in the coming months on the fines and repeat code violations at the mall.

Amaro, the District 1 Council member, and District 4 Florida Sen. Clay Yarborough have lodged complaints with the city and the ownership about the deteriorating condition of the mall.

The city has been issuing citations for violations of Municipal Code Compliance since at least August 2021.

City Chief Communications Officer Phil Perry said that at a Special Magistrate Hearing on Oct. 17, the Regency Square property owner was issued four fines of $500 a day each for repeat violations, backdating the violations to the date the repeat offense was documented, and one order to correct for 30 days with a fine of $250 per day starting Nov. 16.

The city said the hearing puts the current administrative fines at $726,000 and increases at $2,000 per day until the owner achieves compliance or fines increase starting Nov. 16.

More than a dozen citations, some referring to prior notices, for ordinance violations since Aug. 18, 2021, include:

The ceiling in unsanitary condition; ceiling has holes and cracks; roof leaking; mechanical ventilation system is inoperable or damaged; failure to repair holes and cracks in the ceiling; failure to repair ceiling to a sanitary condition; failure to repair AC system; failure to maintain the roof – leaking throughout; damaged ceiling due to the leak in the roof – throughout; ceiling in unsanitary condition – throughout; exposed electrical wiring; and damaged flooring – throughout.

The citations were issued to Regency Mall Realty LLC, Regency CH LLC and Regency Nassim LLC, the mall’s ownership group.

The 2014 purchase included the AMC Theatres property, which Regency Mall Realty then sold a year later to a Kansas City investment group for $26.2 million.

The sale was more than double what Mason and Namdar paid for the entire property, which indicated it made its money back and more on the sale.

Regency Mall Realty made another $7 million in 2016 when it sold the former Belk department store, in the center of the mall, to Impact Church of Jacksonville Inc., which operates in the space.

Yarborough’s Sept. 8 letter to ownership asked it to take action to fix “the current state of distress of the Regency Square Mall.”

He cited a property “afflicted with” problems that include structural deterioration with holes in the ceilings, some with exposed electrical wiring that could pose fire hazards.

Yarborough asked Igal Namdar with Namdar Realty Group and Elliot Nassim with Mason Asset Management to visit the mall and assess the situation.

In an Oct. 3 response to Yarborough, Namdar COO Dan Dilmanian acknowledged the sale:

“We value your concerns and we are pleased to inform you that we’ve finalized a contract for the sale of the mall,” he wrote.

“The new buyer is aware of the necessary repairs and will liaise with the town soon to address the issues.”

Namdar’s sale statement came days after Amaro said Sept. 29 that the community “is tired of the mall ownership.”

He said if owners are not going to be “a productive partner in Arlington, they too should leave.”

Most national retailers have left the mall

As of Oct. 4, only five tenants, including just one national retailer, remained within the east wing of the mall that is open to the public.

New Jersey-based Jimmy Jazz, which sells lifestyle, streetwear and footwear brands, remains open, although Amaro said he understands it will be leaving.

The few other remaining stores and food-court operators appear to be locally operated.

J.C. Penney was the last department store anchor tenant to leave the mall when it closed in October 2020 after 53 years.

Regency Square Mall called itself the largest shopping center in the Southeast when it opened in 1967.

The original developer was the Regency Square partnership, led by the Martin E. Stein family of Jacksonville.

It was filled with more than 100 department stores, boutiques, specialty retailers and food vendors.

The center doubled in size in 1981-82 and added more space in the early 1990s.

In 1991, Regency Square sold the property to an entity that became controlled by General Growth Properties of Chicago.

The Stein family took shopping mall developer Regency Centers Corp. public in 1993 and that company had no ownership in Regency Square.

General Growth went through Chapter 11 bankruptcy reorganization in 2009 and 2010.

By February 2013, General Growth said the mall had been “transferred to the special servicer,” which was trying to renegotiate the loan on the property.

Regency Mall Realty bought the property from General Growth Properties in 2014.