A $98.58 million package of incentives for four blocks of the proposed Gateway Jax development in Downtown Jacksonville is in the Jacksonville City Council’s hands, seven months after being approved by the Downtown Investment Authority board.

Ordinance 2024-0495, which contains the incentives, will be introduced at the June 25 Council meeting.

If passed, it would provide $59.63 million in Recapture Enhanced Value Grants and $38.95 million in completion grants that were recommended for approval by the DIA board in mid-November 2023.

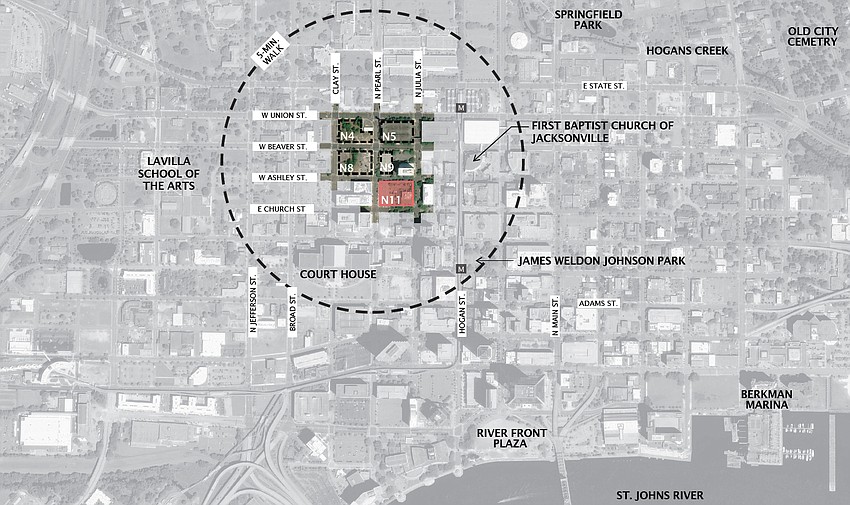

Also known as The Pearl Street District, the $419.3 million mixed-use development comprises residential and retail development planned in the North Core area of Downtown Jacksonville.

During an appearance at the Meninak Club of Jacksonville civic group June 24, Gateway Jax CEO Bryan Moll said it had not been necessary to increase the incentives since their approval by the DIA board. Among the reasons, he said, is that construction costs have plateaued after sharp increases in recent years.

Asked by an attendee if he would like to see the city make any changes to speed up projects, Moll said it would help if the DIA had an on-staff attorney. The city Office of General Counsel now handles the DIA’s legal affairs, as well as those of other city departments and Mayor Donna Deegan’s office.

For large and complex projects like Gateway, he said, the city could speed up the approval process by hiring a DIA attorney who could focus on Downtown development and redevelopment.

Gateway Jax is a commercial real estate venture backed by DLP Capital and sponsored by JWB Real Estate Capital.

As the incentives enter the Council process, Moll said the developers had received a signed a letter of intent from a fitness club company and was negotiating a contract to include a two-story, 35,000-square-foot fitness center in its Block N8 project, a 23-story high-rise building planned for property bounded by Clay, Beaver, Pearl and Ashley streets.

He said talks also were underway with a grocery store for Gateway Jax’s upcoming next Phase 1B.

Moll said they have been intentionally not signing letters of intent and leases with a lot of restaurants.

“They’ll come next,” he said. “We wanted to get a couple of our anchors done.”

According to DIA documents, the total developer investment in the four blocks is $419.3 million.

The DIA board-approved incentives for the four blocks break down as follows:

Block N4: A $14.105 million REV grant and $6.844 million completion grant for a $98.5 million new residential and retail mixed-use seven-story building that includes 381 apartments and 19,155 square feet of retail space. The grant total is $20.949 million.

The property is bounded by Clay, Beaver, Union and Pearl streets.

Estimated construction would start in February 2025 with substantial completion by April 2027.

Block N5: A $2.574 million REV grant and $1.91 million completion grant for the $12.6 million rehabilitation of a 690-space parking garage and the addition of about 15,000 square feet of retail space. The grant total is $4.484 million.

The former First Baptist Church lighthouse garage is at Pearl, Union, Julia and Beaver streets.

Estimated construction would start in April 2025 with substantial completion by April 2027.

Block N8: A $33.888 million REV grant and $25.557 million completion grant for a new $242 million, residential and retail building with 535 apartments.

In the plans Moll presented to Meninak, the Block N8 building was listed with 23 floors, 35,000 square feet of health club and 40,000 square feet of retail space.

The incentives package totals $59.445 million.

Estimated construction would start in December 2024 with substantial completion by October 2027.

Block N11: A $9.061 million REV grant and $4.639 completion grant for a new $66.2 million, seven-story residential and retail building with 205 apartments and 21,333 square feet of retail space. The incentives package totals $13.7 million.

Block N11 is bounded by Pearl, Ashley, Julia and Church streets.

Estimated construction would start in October 2024 with substantial completion by October 2026.

Moll showed a map of the project to Meninak that included Block N9, but it is not part of the first incentives deal.

Moll said the timeline for The Pearl Street District’s Phase 1A and Phase 1B calls for completion within 4½ years.

Long-range plans call for investment of more than $2 billion. Moll said Gateway Jax owns and controls 20 Downtown properties totaling 22 acres, numbers that have grown since plans for the development were announced in September 2023.

Gateway Jax bought a 2.76-acre site at 940 N. Main St. on May 22 from Florida State College at Jacksonville for $4.6 million.

“We have had a couple of additional parcels that we’ve been able to put under control,” he said. “We do that strategically. We’re looking to add to our holdings where it makes sense. The idea is that we’re going to create value in the first phase and then hopefully, build on that moving forward.”