But after that plan was rejected, the company is putting the entire business and its collection, which it values at more than $200 million, up for sale.

Premier Exhibitions Inc. and several subsidiaries, including RMS Titanic Inc., filed for Chapter 11 reorganization in U.S. Bankruptcy Court for the Middle District of Florida in Jacksonville in June 2016.

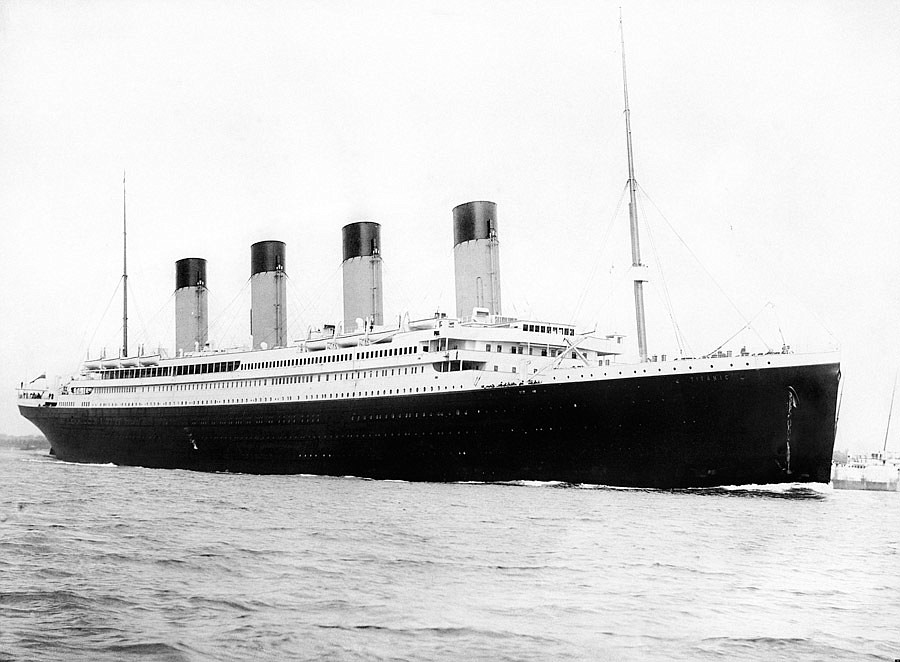

The company owns exclusive rights to recover artifacts from the wreck of the Titanic, and produces exhibitions of artifacts of the doomed ship and other historical items, such as King Tut’s tomb.

When it filed its Chapter 11 petition, Premier valued its Titanic collection at $218 million. Restrictions set by U.S. court rulings and by the French government prevented Premier from selling off those artifacts, in the interest of preserving history.

Premier worked with a French oceanographic institute to recover some of the artifacts.

Premier asked the bankruptcy court for permission to sell less than 1 percent of its collection to pay its debts and emerge from Chapter 11. Its petition listed $12 million in unsecured debt.

However, the company’s motion to sell a limited number of its artifacts was denied by U.S. Bankruptcy Judge Paul Glenn in July 2016. Glenn cited the agreements with the French in his ruling.

Premier has not filed a reorganization plan or disclosure statement but last month, it filed a Plan Support Agreement to sell the Titanic assets and/or the entire company.

In court and Securities and Exchange Commission filings, Premier said the agreement reached with its creditors sets a process to take bids and sell the company to resolve the Chapter 11 case.

The plan calls for interested parties to submit bids by July 21, and it expects to complete the process of finding a buyer or buyers by January.

Premier is a publicly traded company headquartered in Atlanta, but it filed its Chapter 11 case in Jacksonville because the company and some of its subsidiaries are incorporated in Florida.

The company made its money by selling tickets and merchandise from its various exhibitions.

In its original court filings, the company blamed its financial problems on an “incredibly unprofitable” exhibition about the “Saturday Night Live” TV show in New York that closed shortly before it filed the Chapter 11 petition.

Premier’s stock continues to trade in the OTC markets and the price jumped from about $3 in May, before the sale agreement was announced, to about $6 recently.

A committee of equity holders is supporting the sale plan, in which stockholders would be paid off after other creditors are paid.

Peak 10 expands with acquisition

Cloud computing and data center company Peak 10 Inc. announced a major acquisition last week, agreeing to buy ViaWest Inc. for $1.675 billion in cash.

Peak 10 is headquartered in Charlotte, but started its operations in Jacksonville, where it opened its first data center in 2000. The company added a second Jacksonville data center in 2007.

The company has 16 U.S. data centers and merging with ViaWest will expand its operations to 20 markets, including international locations in Amsterdam and Calgary.

ViaWest CEO Nancy Phillips said in a news release the merger will create “the largest privately held” provider of data center infrastructure, cloud computing and IT solutions in North America.

Peak 10 was acquired in 2014 by San Francisco investment firm GI Partners. Ironically, GI Partners was a lead investor in ViaWest at the time but it sold that company three months later to Shaw Communications Inc., a publicly traded Canadian firm. Shaw paid $1.2 billion for ViaWest.

Shaw is using its profit from the ViaWest sale to invest in other businesses.

“The outlook for ViaWest remains robust, though the North American colocation and managed services industry is consolidating and scale is becoming an important factor for continued long-term success,” CEO Brad Shaw said in a news release.

Scott in Connecticut to woo companies

Gov. Rick Scott is heading to Connecticut this week for an “economic development mission” at a time when a major corporation based there with significant Jacksonville operations is considering a headquarters move.

Hartford-based Aetna Inc. last month said it is talking to other states about a possible headquarters relocation.

It would be a major blow to Connecticut, where the Aetna Fire Insurance Co. began operations in Hartford in 1819.

Although Jacksonville has lost some insurance company headquarters to mergers in recent years, it has long had a reputation as an insurance capital.

Aetna, which is relocating from the Southbank to the Gramercy Woods office park on the Southside, employs more than 800 people in Jacksonville. In the latest Fortune 500 rankings, Aetna was 43rd.

A news release from the governor’s office last week did not name any specific targets, but said Scott is hoping to convince Connecticut businesses that Florida offers a better business environment than Connecticut.

Kaman extends copter production

Kaman Corp. said last week it will continue production of K-MAX helicopters, which it builds in Jacksonville, through at least 2019.

Connecticut-based Kaman resumed production of the heavy-lift utility helicopter in 2015 with an initial commitment to build at least 10.

The company’s annual report said it delivered the first airframe from its Jacksonville facility in December and sent it to its Bloomfield, Connecticut, plant for final assembly. It is scheduled for delivery to its customer in this quarter.

Kaman said continued demand for the K-MAX prompted the company to extend production.

The K-MAX is used for “firefighting, logging, powerline construction and other missions requiring repetitive aerial lift capabilities,” the company said.

International Baler records profit

Jacksonville-based International Baler Corp. reported a profit of $48,119, or 1 cent a share, for the second quarter ended April 30, reversing a loss of $56,131, or 1 cent a share, the previous year.

Net sales of $2.67 million were about unchanged from last year.

The maker of balers used for recycling and waste disposal said the improved results came from significantly lower selling and administrative expenses related to reductions in personnel.

International Baler said in its annual report it had 54 full-time employees at the end of fiscal 2016.

The company operates from a 62,000-square-foot plant in Northwest Jacksonville.

Duos in New York subway test

Jacksonville-based Duos Technologies Group Inc. last week said it has an agreement with the New York City Transit Authority to test and evaluate technologies to provide warnings when people or objects enter onto subway tracks.

The company did not say how much money it could make if its technology is adopted, but CEO Gianni Arcaini expressed confidence about the pilot program in a news release.

“This program will be another testimony of how we can effectively utilize our core of intelligent technologies that have been successfully deployed for our transportation clients,” he said.

Duos reported revenue of about $1 million and a net loss of $2.3 million in the first quarter this year.

Duos also last week filed plans with the SEC to raise capital by selling about 2.2 million additional shares of stock at $5 to $6 each.

The company two months ago enacted a 1-for-35 reverse split of its stock to raise its trading price and seek a listing on the Nasdaq Capital Market.

The stock continues to trade on the OTCQB market as Duos waits for approval from Nasdaq.

Green Energy offers marijuana insurance

Jacksonville-based Green Energy Enterprises Inc. continues seeking ways to profit from the growing legalized marijuana business.

The company announced it is launching an insurance business for companies engaged in marijuana production.

“States continue to tweak their programs, which creates uncertainty for businesses and the industry as a whole. Insurance for this industry will provide reassurance to these operations creating operational and financial confidence and eliminate lingering uncertainty and volatility for MJ companies,” Green Energy said in a news release.

Green Energy changed its name from Quasar Aerospace Industries Inc. in 2015 as it sought to enter the legal and medical marijuana business.

The company operates a flight training school at Herlong Airport on Jacksonville’s Westside and made a series of announcements several years ago promising big aerospace acquisitions that never materialized.

Green Energy says it remains committed to its flight training operations as it looks for opportunities in the marijuana industry.

The company reported revenue of $67,776 and a net loss of $7,428 for the first quarter.