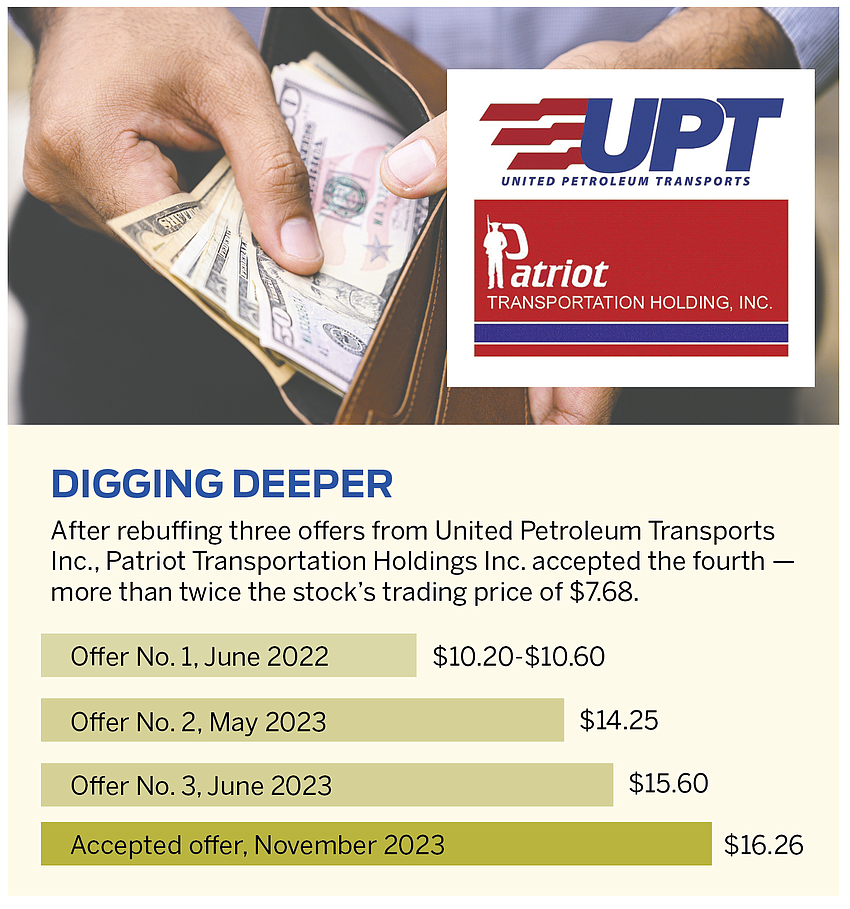

Patriot Transportation Holding Inc. was not looking for a buyout when United Petroleum Transports Inc. first approached the Jacksonville-based trucking company in June 2022.

After rebuffing UPT’s initial offer, the company held out for more than a year until agreeing to a bid more than twice its trading price, according to a proxy statement filed by Patriot.

Oklahoma City-based UPT and Patriot agreed Nov. 1 for the buyout at $16.26 per Patriot share in cash, representing a 111.7% premium to Patriot’s closing price of $7.68 the day before.

But just to be certain, Patriot Chairman Tom Baker and his uncle John, as lead negotiators, made sure the agreement included a go-shop provision until Dec. 1 to see whether any better offers would come in.

As of the Nov. 14 date of the proxy filing, no other parties expressed interest.

The two Bakers, who are each board members of Patriot but not executive officers, control a combined 26.6% of the company’s stock.

Patriot, which transports fuel products in the Southeast, was spun off from Jacksonville-based construction materials company Florida Rock Industries Inc. The Baker family also had a controlling interest in Florida Rock before it was sold to Vulcan Materials Co. in 2007.

Tom Baker is president of Birmingham, Alabama-based Vulcan.

According to the proxy statement, Patriot CEO Robert Sandlin was first approached by UPT about a possible acquisition in June 2022.

Like Patriot, UPT specializes in transportation of petroleum products.

At a meeting with UPT in September 2022, John Baker “stressed that the Company was not for sale” but would consider an attractive offer, the proxy said.

UPT made an offer the next month of $10.20 to $10.60 per share, with Patriot’s stock trading at $8.06 at the time.

“Mr. Sandlin communicated that the Company had no interest in a transaction at such price,” the proxy said.

No new offers came in until April 2023, when UPT contacted Sandlin again seeking to resume negotiations.

UPT made a new offer in May of $14.25 a share, with Patriot trading at $9.64.

Patriot rejected that offer and UPT came back in June with an offer of $15.60 a share.

After Sandlin informed UPT it needed to come up with a little more, UPT raised the offer to $16.26.

“After review and discussion, the Board unanimously concluded that it likely represented the best value reasonably available to shareholders and that one-on-one negotiations with UPT with a post-signing market check was the best strategy to secure the most favorable transaction for the Company and its shareholders with the least uncertainty, risk and expense,” the proxy said.

So, with the one-month go-shop provision added to the deal, Patriot accepted the $66 million buyout offer.

Patriot’s trading price jumped to $15.60 on Nov. 1 after the buyout was announced and has remained close to that level since.

Patriot has not set a date for a special meeting of stockholders to approve the deal, but the proxy said it hopes to complete the buyout by the end of 2023 or in early 2024.

Fidelity National Financial Inc. said in a Nov. 21 Securities and Exchange Commission filing that a cybersecurity incident disrupted its business.

The Jacksonville-based title insurance company said an unauthorized third party accessed certain systems, prompting it to block access to those systems.

Fidelity did not give details about how much of its business was affected.

“FNF will continue to assess the impact of the incident and whether the incident may have a material impact on the Company,” it said.

Fidelity said it was “working to restore normal operations as quickly and safely as possible” but it gave no update on the situation through the Thanksgiving holiday weekend.

Cadrenal Therapeutics Inc.’s stock has been a flop since its initial public offering in January at $5 per share.

With no products on the market and no revenue, the Ponte Vedra Beach-based pharmaceutical research company has been trading below $1 since July.

However, H.C. Wainwright analyst Joseph Pantginis sees long-term potential in Cadrenal and became the first analyst to initiate coverage on the company, rating the stock as a “buy” with a $3 price target.

Cadrenal is developing an anticoagulant drug called tecarfarin, which it sees as an alternative to a commonly prescribed treatment called warfarin.

“Our belief in Cadrenal’s approach is grounded in the extensive clinical trials tecarfarin has undergone since the early 2000s,” Pantginis said in his Nov. 20 report.

“These 11 trials have involved over 1,000 subjects, including healthy adults and individuals with chronic kidney disease, and have consistently shown favorable tolerability profiles,” he said.

Tecarfarin was invented by UF graduate Pascal Druzgala in the late 1990s, according to Cadrenal CEO Quang Pham.

Pham has been seeking to develop the drug for use through several companies since 2015. He formed Cadrenal in 2022.

“The resurgence of tecarfarin under Cadrenal’s guidance is justified, as the company intends to focus on specific medical areas where tecarfarin holds advantage over warfarin,” Pantginis said.

“Cadrenal aims to carve a unique niche in the field of anticoagulation therapy, which has seen minimal refinement despite warfarin’s seven-decade dominance and the recent introduction of DOACs (direct oral anticoagulants).”

Pantginis does not project Cadrenal producing revenue until 2027, so he advised investors to take a long-term perspective on the company.

“We believe it is essential for potential investors to consider the extended timeline and financial requirements,” he said.

A Hong Kong-based hedge fund that took an activist stake in GEE Group Inc. has slightly reduced its position in the Jacksonville-based staffing company.

Goldenwise Capital Group Ltd. said in a Nov. 22 SEC filing it has 4.9% of GEE Group’s stock, down from 5.2% it reported in an August filing.

After the August filing, Bloomberg News reported GEE Group was Goldenwise’s first target as it looked to take on activist positions in companies.

Goldenwise founder Huakun Ding told Bloomberg the fund was targeting firms with market values up to $500 million.

The SEC filings said Goldenwise has talked with GEE Group’s management.

“Since May 20, 2023, Goldenwise Capital Group has engaged, and intends to continue to engage, in discussions with management of the Issuer regarding opportunities to unlock value at the Issuer, including: Share Repurchase, Corporate Governance Improvement, Potential Selling of the Company,” the latest filing said.

According to its most recent proxy statement, investment firm Red Oak Partners is GEE Group’s largest shareholder with 8.8% of the stock.

Boca Raton-based Red Oak took an activist position in the company in May by seeking to nominate two directors to GEE Group’s board.

GEE Group and Red Oak reached a cooperation agreement in August to add two directors to the board.

Salt Life opened a retail store at the St. Augustine Premium Outlets in October as part of an expansion of the brand founded 20 years ago in Jacksonville Beach, according to parent company Delta Apparel Inc.

The company said in a Nov. 20 news release it will open Salt Life’s 28th store in December in Williamsburg, Virginia.

Delta said Salt Life’s store network consists of 15 full-price stores and 13 outlet stores, including the new store in the St. Augustine mall at Florida 16 and Interstate 95.

Duluth, Georgia-based Delta bought the apparel brand for $37 million in 2013.

It does not own the three Salt Life Food Shack restaurants in the Jacksonville area.

“Sales in Salt Life’s retail channel are among the most profitable sales across our entire company and the consistent gains we see in key metrics such as conversion rate and transaction value continue to affirm our significant investment in this area,” Delta CEO Robert Humphreys said in the news release.

Salt Life accounted for $46.5 million of Delta’s $323.9 million in revenue in the nine-month period ended July 1.

The company sells apparel under the Delta, Salt Life and Soffe brands.

The Salt Life business produced operating earnings of $6.5 million in the first nine months of the fiscal year but the entire company had a net operating loss of $11 million.

Delta announced Oct. 2 it received an unsolicited offer to buy Salt Life, and that its board of directors was evaluating the offer.

The company has not said anything about the offer since then.

Medtronic plc reported low-single-digit percentage second-quarter revenue growth in its Jacksonville-based division, which makes surgical instruments for ear, nose and throat doctors.

The Dublin, Ireland-based medical device maker does not report more detail on the ENT business in its quarterly reports.

Medtronic said total revenue in the quarter ended Oct. 27 rose 5.3% to $8 billion but adjusted earnings fell by 5 cents per share to $1.25.

“The underlying fundamentals of our business are strong, and our growth was broad-based across multiple businesses and geographies,” CEO Geoff Martha said in a Nov. 21 conference call, according to a transcript posted by the company.

“Our new product launches are performing well and driving growth across many businesses,” he said.

“And when we look ahead to the back half of our fiscal year, those launches, combined with several recent regulatory approvals, give us confidence in our ability to continue delivering dependable growth.”