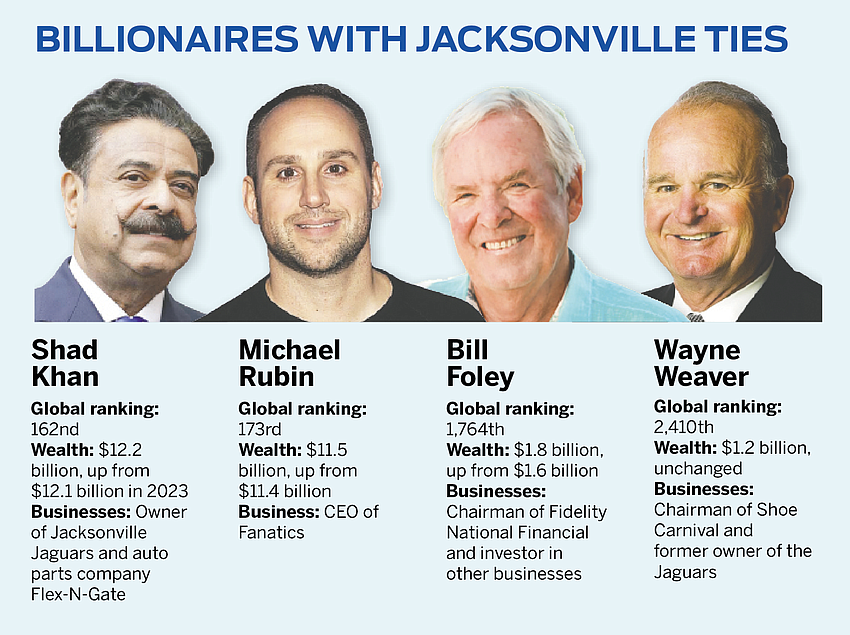

Three of four billionaires with close ties to Jacksonville increased their wealth in the past year, but only one moved higher in Forbes magazine’s annual ranking of the world’s richest people.

Jacksonville Jaguars owner Shad Khan remains the wealthiest of the four with a net worth estimated at $12.2 billion by the magazine, about $100 million more than last year.

However, Khan’s ranking fell from 144th in 2023 to 162nd in the list of 2,781 billionaires around the world published by Forbes on April 2.

Wayne Weaver, who sold the Jaguars to Khan in 2012, maintained his wealth of $1.2 billion and fell from 2,259th last year to 2,410th in the 2024 ranking.

Fanatics Inc. CEO Michael Rubin grew his wealth by about $100 million to $11.5 billion but his ranking slipped from 151st to 173rd.

Fidelity National Financial Inc. Chairman Bill Foley was the only one of the four to move up on the list, as his wealth grew by about $200 million to $1.8 billion to rank 1,764th, from 1,804th in 2023.

Although Khan gains more notoriety from his ownership of the Jaguars, he started his fortune by growing Illinois-based auto parts company Flex-N-Gate Corp.

A previous list by Forbes said Flex-N-Gate ranked as the 69th-largest private company in the U.S. with estimated 2023 revenue of $8.3 billion, up from $7.9 billion the year before.

Forbes lists Naples, Florida, as Khan’s residence.

Weaver’s main business, after selling his majority interest in the Jaguars, is publicly traded footwear chain Shoe Carnival Inc.

Weaver and his wife, Delores, own about one-third of the Evansville, Indiana-based company’s stock.

Foley is best known for growing Jacksonville-based Fidelity into a Fortune 500 company but he has interests in a number of businesses, including ownership of the Vegas Golden Knights hockey team.

Foley moved from Jacksonville to Las Vegas after being awarded the NHL expansion franchise in 2016.

Rubin acquired then Jacksonville-based Fanatics for $277 million in 2011 from founders Alan and Mitchell Trager.

The sports merchandise giant, which maintains its commerce headquarters in Jacksonville, is expected to launch an initial public offering at some point and its value has been pegged by many financial news sources at more than $30 billion.

MLB defends Fanatics in uniform controversy

Rubin and Fanatics have been under fire since spring training began in February over new uniforms for Major League Baseball players manufactured by Fanatics.

Rubin defended his company in early March, saying the uniforms were designed by Nike and Fanatics was manufacturing them according to those specifications.

Among the complaints at the time were that the uniforms were made with a see-through fabric that could show players’ underwear.

As the regular season began at the end of March, the uniforms were criticized again for exposing excessive sweat stains.

This time, MLB came to Fanatics’ defense in a statement issued to sports news site The Athletic on April 4.

“Nike chose the letter sizing and picked the fabric that was used in these jerseys. Fanatics has done a great job manufacturing everything to the exact specifications provided by Nike,” the statement said.

Cannabis stocks benefit from Florida ballot measure

The Florida Supreme Court’s April 1 decision to allow a ballot measure on personal marijuana consumption in the state sparked a rally in cannabis-related stocks, as investors speculate the potential of the Florida market.

Two Canada-based companies were the big winners, with Canopy Growth Corp. rising as much as 54% in the two days after the ruling and Aurora Cannabis Inc. doubling in price.

Quincy-based Trulieve Cannabis Corp., which has Florida’s largest network of medical marijuana dispensaries, rose as much as 10%. But the company, which was the primary sponsor of the ballot initiative to allow recreational marijuana use, projects a big market if the measure is approved in November’s election.

“We are thankful that the Court has correctly ruled the ballot initiative and summary language meets the standards for single subject and clarity. We look forward to supporting this campaign as it heads to the ballot this Fall,” Trulieve CEO Kim Rivers said in a news release.

Trulieve operated 134 of the 627 authorized medical marijuana dispensaries in Florida as of March 29. Its website shows seven locations in Northeast Florida.

The company estimates the medical marijuana business will generate more than $2 billion in sales in 2024, with more than 875,000 patients registered in the program, but said the market potential for Florida is $6 billion if the measure is approved.

The company reported revenue of $1.13 billion in 2023. It had an adjusted net loss of $70 million for the year.

LFTD Partners reports profitable year

Early April 1, before the court’s decision was announced, Jacksonville-based cannabis products company LFTD Partners Inc. officials complained about regulatory pressure on the industry in the company’s year-end conference call.

LFTD’s main business is a Kenosha, Wisconsin-based company called Lifted Made, which manufactures and sells hemp-derived and psychoactive products under the Urb brand.

The company is officially headquartered in the Jacksonville home office of LFTD Partners CEO Gerard Jacobs.

“We are very aware that hemp-derived cannabinoid-infused products continue to be under regulatory attack at both the federal and state levels,” Jacobs said.

“Prohibition of or tighter regulation of hemp-derived cannabinoid infused products have been adopted or proposed in many states that are significant markets for Lifted, including Florida.”

“These federal and state regulatory challenges are material risks to Lifted Made’s business and are continuing to require us to expense substantial management time, effort and money in regard to lobbying efforts.”

LFTD reported 2023 earnings fell 70% to $2.2 million, or 13 cents a share, but Jacobs said the profit was significant.

“Unlike the vast majority of publicly traded companies in the cannabis industry, which were unprofitable during Q4 2023 and for calendar year 2023, LFTD Partners had another profitable quarter in Q4 2023 and another profitable year in 2023,” he said.

LFTD’s sales fell 10% last year to $51.6 million.

President and Chief Financial Officer William Jacobs, Gerard’s son, cited several headwinds for the sales decline.

They included “greater competition in the marketplace for hemp-derived and psychoactive products, more distributors creating their own brands and selling their own branded products with low prices, increased competition for products containing more milligrams of cannabinoids per unit at a lower price point and other competing brands paying distributors and wholesalers for valuable shelf space.”

LFTD’s stock fell 40 cents during the week after announcing earnings to close at $1.60 on April 5.

Duos Technologies revenue drops

Duos Technologies Group Inc. reported April 1 that 2023 revenue dropped 50% to $7.5 million, and the company had a net loss of $11.2 million for the year.

The Jacksonville-based railroad technology company said its results were affected by customer-driven timing delays in installing its technology, and it is transitioning to a subscription-driven business model with recurring revenue.

“We anticipated the short-term financial headwinds, as manifested in our results for last year, would provide additional challenges for us in executing our strategy,” CEO Chuck Ferry said in Duos’ conference call, according to a company transcript.

“I am pleased to report that, despite these challenges, our mid- and long-term outlook remains unchanged, and I’m expecting much-improved performance for 2024,” he said.

Ferry said Duos has demonstrated its technology, which helps railroad safety, to customers and to members of Congress and received a positive response.

“Our challenge is to turn that positive reaction into contracts that grow revenue and profits,” he said.

“The primary risks continue to be project delays out of our control and timing of revenue recognition with current customers and the slow adoption of this technology with new customers in the rail sector,” he said.

“We will continue to press hard into the rail sector, which we know will adopt our technology at a large scale, but also initiate efforts to diversify our offerings into the broader AI value chain.”

Duos was one of the best-performing stocks among Jacksonville-based companies in the first quarter of 2024, rising 50% to $4.34.

However, it fell by $1.05 in the first week of the second quarter to $3.29 after releasing its final 2023 results.

Warren Equity raises $550 million for investment fund

Jacksonville-based Warren Equity Partners said April 2 it closed more than $550 million in capital commitments for an investment fund.

The private equity firm invests in companies that maintain, operate and upgrade infrastructure assets.

Warren Equity said it has about $4.6 billion in assets under management and has completed 124 transactions.

The firm’s latest fund is called Warren Equity Partners ELIDO Fund II.

“Our focus with ELIDO II, consistent with prior funds, will be to invest in and build great companies, leveraging all of our resources at Warren,” Managing Partner Steven Wacaster said in a news release.

Hearthside Food sells Jacksonville assets

Denver-based Custom Made Meals LLC said April 4 it acquired the Jacksonville ready-to-cook and ready-to-heat manufacturing assets of Hearthside Food Solutions.

Custom Made Meals said Hearthside Jacksonville produces chef-curated meal and appetizer solutions to grocery chains and food service distributors across the Eastern U.S., with a manufacturing facility built in 2005.

The company said the acquisition expands its regional footprint.

Hearthside, headquartered in Downers Grove, Illinois, operates 37 production facilities in 12 states.

Terms of the deal were not announced.