A New York real estate investment group added another 75.3 acres to its more than 35,600 acres of timberland in St. Johns County.

Managing broker-dealer Ruane, Cunniff & Goldfarb LLC, an investment adviser known for managing the Sequoia Fund, has been buying property in St. Johns County since the end of 2017. It now owns more than 35,600 acres.

The investment sponsor, through 206 Timber LLC, paid $3.12 million for the property, about $41,501 per acre, April 24.

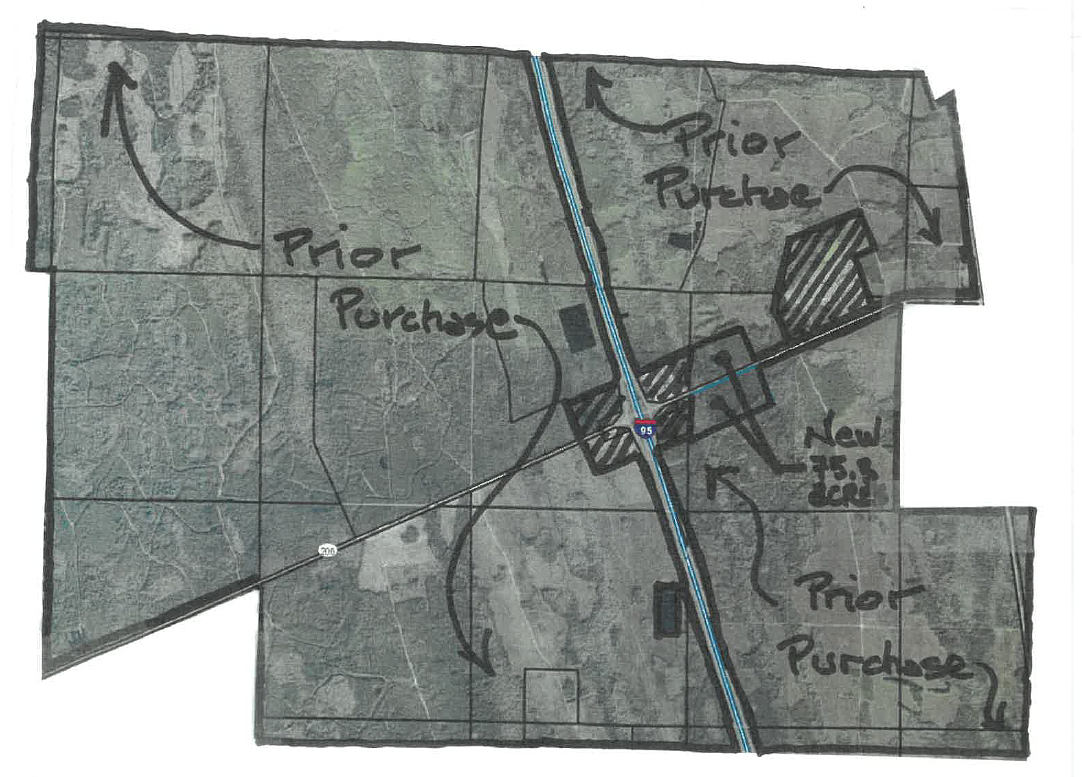

The acquisition adds to land purchases around Florida 206 and Interstate 95.

The seller was Frank W. Pepe Jr., The Frank W. Pepe Jr. Revocable Trust and Pepe Family Holdings Ltd.

Previous acquisitions stretch from U.S. 1 west to County Road 13A South, and from County Road 214 south to the Flagler County line.

The investment fund sponsor paid more than $149.42 million for the 35,644.88 acres.

St. Johns County property appraiser records indicate most of the ownership is based at 9 W. 57th St., Suite 5000, in New York City, the same address as Ruane, Cunniff & Goldfarb LLC.

The ownership bought the land from Rayonier Atlantic Timber Co., Raydient LLC, Rayonier Forest Resources L.P., Rayonier Timber Co. No. 1 Inc., BBC Elkton LLC, Robinson Improvement Co., Osceola Lakes LLC, Toccoli Land Co. LLC, Meldrim Heritage Timberlands LLC, Parrish Family Trust, Cumberland Street LLC, KG Development LLC and Frank W. Pepe Jr, The Frank W. Pepe Jr. Revocable Trust and Pepe Family Holdings Ltd.

Ruane, Cunniff & Goldfarb says on ruanecunniff.com that it is an investment adviser that runs separately managed accounts using strategies similar to that of the Sequoia Fund.

The Sequoia Fund is a long-term equity strategy mutual fund founded in 1970 that focuses on the purchase of undervalued mid- and large-capitalization companies with growth potential.

Most of the property has a designated land use of rural silviculture and agricultural.

More intensive development would require county land use and zoning changes.