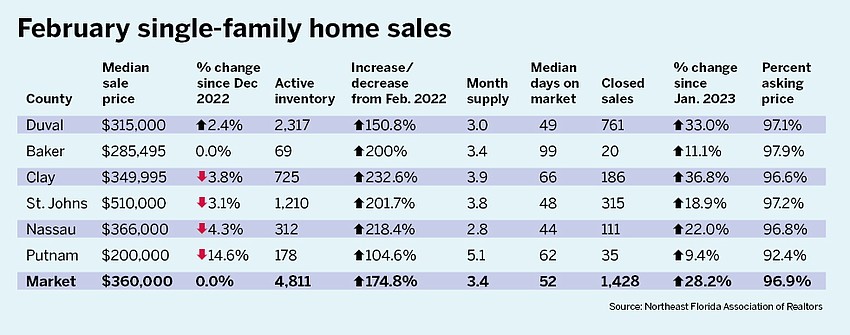

Buyers are reacting favorably to a single-family housing market where median prices generally are falling, according to the February report by the Northeast Florida Association of Realtors.

The median price of a single-family home in Northeast Florida in February was $360,000, almost unchanged from $359,950 in January.

NEFAR tracks home sales activity in Baker, Clay, Duval, Nassau, Putnam and St. Johns counties.

The median price increased only in Duval County, from $307,500 in January to $315,000 in February.

Baker County remained steady with no change at $285,495.

The remaining four counties saw median prices drop in February.

In Nassau County, the median price dropped from $382,635 in January to $366,000 in February. It was down from $410,000 in February 2022 and down from a 2022 high of $417,513 in November.

Northeast Florida closings in February were up 28.2% from January, to 1,428 from 1,114.

Diana Galavis, 2023 NEFAR president, said greater inventory and buyer acceptance of current interest rates helped fuel the increased sales numbers.

“Increased listings on the market provided buyers with more inventory to shop and potentially secure a home,” she said in a news release.

“This is a reflection that buyers are more comfortable with the fluctuating market and were ready to make a move in securing real estate.”

Inventory was up 174.8% over the year to 4,811 homes on the market compared with 1,751 in February 2022.

The Home Affordability Index remains stable.

A year ago it was near the target number of 100 at 98. In 2023, the number has remained at 76 after reaching a low of 67 in October 2022.

The index measures whether a typical family earns enough to qualify for a mortgage on a typical home, based on current interest rates, median income and median home prices. A higher number means greater affordability.