After he presented the proposed city budget Monday morning to City Council, Mayor Lenny Curry pointed out that the revenues and expenditures plan for 2017-18 does not include any tax increases.

Tax rate increases, that is.

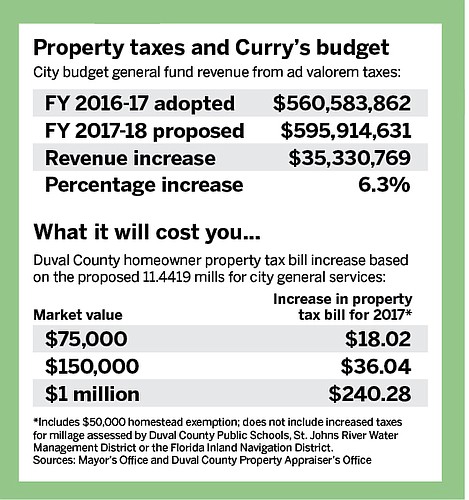

Curry’s proposal for revenue from ad valorem taxes is based on 11.4419 mills for city general services (collection per $1,000 of taxable value), but the taxable property value of property in Duval County increased in the past year from $55.3 billion to $58.6 billion, about 6 percent.

The budget submitted Monday shows projected ad valorem tax revenue of nearly $596 million, compared to about $561 million the previous year.

That will lead to the city getting about $35 million in additional property tax revenue in 2017-18 compared to last year — and property owners will see slightly larger figures on the Notice of Proposed Property Taxes they’ll receive in late August, also called the Truth in Millage Notice (TRIM).

According to Duval County Property Appraiser Jerry Holland, the 6 percent increase in taxable value for the 2017 certified tax roll is based on new construction and the current improvement in Jacksonville’s real estate market.

For 2017, the total market value rose to $96.5 billion, up from $92 billion in 2016. The market value of new construction is $1.2 billion, up from 2016’s $1.1 billion, he said.

“The good news is the maximum taxable value a homesteaded property will go up will be the amount of the Consumer Price Index — 2.1 percent,” Holland said.

That’s because the Florida Constitution was amended in 1995 to cap annual taxable property value increases at a level equal to 3 percent, or the change in the CPI, whichever is lower.

The increased value of the property, deducting the $50,000 homestead exemption, is multiplied by the city general services millage rate to derive the taxpayer’s contribution to the city budget.

In addition, property taxes over which the city has no control and from which it derives no revenue — taxes collected by Duval County Public Schools (6.8020 mills), the St. Johns River Water Management District (0.2885 mill) and the Florida Inland Navigation District (0.0320 mill) also will go up based on increased value.

While Curry proposed no increase in the general services tax rate, council has the option during its budget deliberations to modify the millage rate, higher or lower.

On Tuesday, the council auditor recommended a small increase in the millage rate.

Holland said based on his experience as a council member 1999 to 2005, including council president in 2002-03, he would not recommend a reduction in the general services millage rate.

He said reducing the millage rate could put the city in the position that if the market value of real estate declines — as it did during the recession of 2007 — ad valorem revenue might not meet the city’s needs for essential services.

Holland also said he’s concerned about the so-called “Super Homestead” constitutional amendment that will be on the ballot in November 2018.

If approved by voters, it would increase the homestead exemption to $75,000 on homes valued at $125,000 or more and that would result in a projected loss of tax revenue of about $26 million per year.

“I think you have to look further than the year in front of you,” said Holland.

(904) 356-2466